SBV collapse.

Moderator: Jesus H Christ

- Screw_Michigan

- Angry Snowflake

- Posts: 21095

- Joined: Wed Feb 17, 2010 2:37 am

- Location: 20011

Re: SBV collapse.

Yeah, bail out a bunch of rich assholes but how DARE Jimmy or Johnny failed student get $20k of student loans forgiven? FUCK THEM

https://www.washingtonpost.com/us-polic ... -deposits/

https://www.washingtonpost.com/us-polic ... -deposits/

- Sudden Sam

- Official T1B Gigolo

- Posts: 3890

- Joined: Thu Dec 08, 2022 5:38 pm

Re: SBV collapse.

So, once again, we see these “marginalized” people spending their time and energy worrying about their sex life and the sex lives of like-minded folks rather than doing their goddamn job.

Fuck whatever adult you want. No one cares. STFU and do your job.

“Choosing leaders for the color of their skin or their sexual orientation, and not the content of their capabilities, demeans and debases them. It renders their achievements suspect and their positions less trusted, for always will a whiff of nepotistic stink accrue to them.”

Fuck whatever adult you want. No one cares. STFU and do your job.

“Choosing leaders for the color of their skin or their sexual orientation, and not the content of their capabilities, demeans and debases them. It renders their achievements suspect and their positions less trusted, for always will a whiff of nepotistic stink accrue to them.”

-

Kierland

Re: SBV collapse.

You are right picking all these people because of their skin color is killing our country.

- Donnie Baker's Ghost

- I swear to god . . .

- Posts: 1091

- Joined: Thu Sep 29, 2022 10:48 pm

- Bill in Houston

- Eternal Scobode

- Posts: 1151

- Joined: Wed Jun 10, 2020 12:29 am

Re: SBV collapse.

Millions of Americans who hold trillions of dollars in retirement accounts invest those assets in stocks. Many of them don’t even know what the tax rate will ultimately be on their distribution.smackaholic wrote: ↑Sun Mar 12, 2023 5:52 pm

Of course the tax isn’t the risk, dumbfukk. It is a reduction of the reward for taking the risk and therefore, it will affect investor’s decision on how much to risk or whether they should even bother.

This says what about your theory?

-

Kierland

Re: SBV collapse.

I was agreeing with him. That’s not Whataboutism, but you hate education so there is that.

- Donnie Baker's Ghost

- I swear to god . . .

- Posts: 1091

- Joined: Thu Sep 29, 2022 10:48 pm

Re: SBV collapse.

And now with a fallacy. I get it, you just can't help yourself. It's in your firmware.

Shut up, Randy!

Re: SBV collapse.

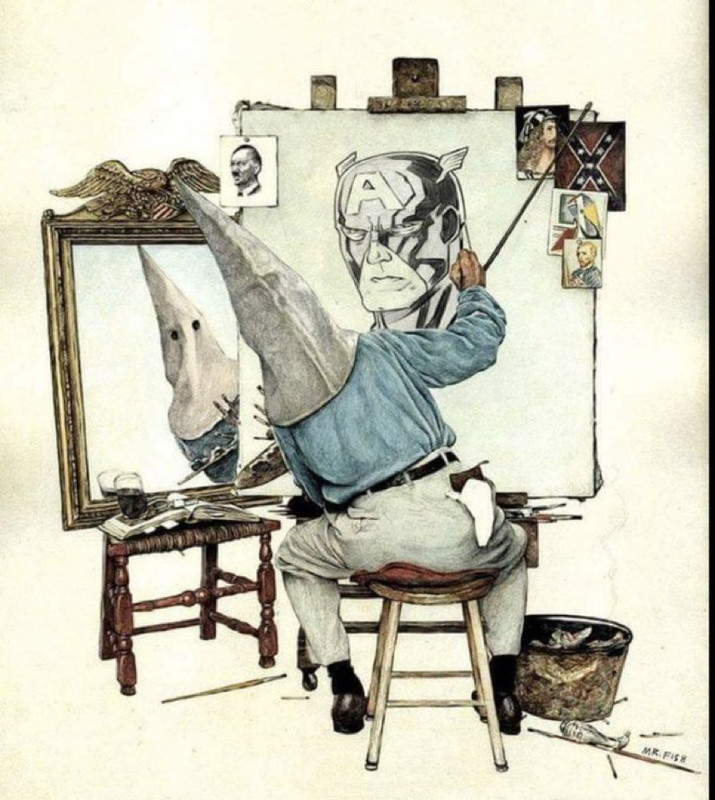

WhatAbout Cramer? He's been an idiot for years, pandering to wanna be investors. Please stay on subject.LTS TRN 2 wrote: ↑Sun Mar 12, 2023 10:59 pmAs usual, Meat Suck (aka, Mikey), you have no idea what you're reflexively attempting to trash. Perhaps you're more comfortable wallowing in the wisdom of this guy--and why wasn't he jailed back in '08? :oMeat Head wrote: ↑Sun Mar 12, 2023 5:13 pmSeems a bunch of top shelf sensationalist trendy bullshit.LTS TRN 2 wrote: ↑Sun Mar 12, 2023 8:36 am Anyone hip to this site? I mean if you want the top shelf lingo and analysis..

https://wolfstreet.com/

Wolf Richter may be a next generation bot.

CNBC analyst Jim Cramer is once again being pilloried on social media after a clip resurfaced showing the “Mad Money” host recommending viewers buy shares of Silicon Valley Bank’s parent company, which owns the tech-driven commercial lender that swiftly collapsed on Friday.

“The ninth-best performer to date has been SVB Financial (the bank’s parent company). Don’t yawn,” Cramer told viewers during a Feb. 8 episode of “Mad Money.”

Cramer listed SVB Financial among his “biggest winners of 2023 … so far” alongside blue-chip stocks such as Meta, Tesla, Warner Bros. Discovery, and Norwegian Cruise Line.

“This company is a merchant bank with a deposit base that Wall Street has mistakenly been concerned by,” Cramer said in the clip.

Re: SBV collapse.

Obviously Wolf Richter is infinitely more asute and informed about the market issues--especially in Silicon Valley--but since you're such a simplistic and clueless boring old fart, it appears that someone like Cramer is much more your speed. Try to stay awake. :wink:

Before God was, I am

-

Kierland

Re: SBV collapse.

Not how fallacies work.JPGettysburg wrote: ↑Mon Mar 13, 2023 6:48 pmThat by taxing only the rich, we can make 30 fukking trillion in debt, go bye bye.

That fallacy you imbecile.

- smackaholic

- Walrus Team 6

- Posts: 21748

- Joined: Sat Jan 15, 2005 2:46 pm

- Location: upside it

Re: SBV collapse.

You're back on the ignore list. I can't handle your fixation for being the alpha male all the time. You have to be right even when you're wrong and when challenged you double down on stupid. It's exhausting.

[/quote]

As I was saying last week, I've never used the ignore feature because as Nish said, "A board NEEDS its tards", but damn, he really does stretch that rule to its limits. I think I may just have to do the same, for the reasons you state. He absolutely refuses to debate a topic like an adult.

mvscal wrote:The only precious metals in a SHTF scenario are lead and brass.

- smackaholic

- Walrus Team 6

- Posts: 21748

- Joined: Sat Jan 15, 2005 2:46 pm

- Location: upside it

Re: SBV collapse.

I stand corrected then. I did see it listed somewhere as SBV with the explnation that that was its ticker.Bill in Houston wrote: ↑Sat Mar 11, 2023 6:15 pmSilicon Valley Bank’s ticker is SIVB.smackaholic wrote: ↑Sat Mar 11, 2023 3:10 pmSBV is their stock ticker, apparently.Softball Bat wrote: ↑Sat Mar 11, 2023 2:58 am This is in the *DOOM* thread.

viewtopic.php?f=2&t=50281&start=2680

And btw, it is SVB -- check your thread title.

I don’t believe it would be very difficult for you to be correct, rather than stupid.

mvscal wrote:The only precious metals in a SHTF scenario are lead and brass.

- smackaholic

- Walrus Team 6

- Posts: 21748

- Joined: Sat Jan 15, 2005 2:46 pm

- Location: upside it

Re: SBV collapse.

That's what your master Sleepy Joe did. Or are you gonna figure out a way to pin this on Trump too.Screw_Michigan wrote: ↑Mon Mar 13, 2023 12:08 am Yeah, bail out a bunch of rich assholes but how DARE Jimmy or Johnny failed student get $20k of student loans forgiven? FUCK THEM

https://www.washingtonpost.com/us-polic ... -deposits/

He did it because the overwhelming majority of those account are held by Silicon Valley tech companies. And they are your people.

So, the precedent is now set. FDIC now guarantees accounts to 250K, or maybe 250 billion, if Joe feels like it.

mvscal wrote:The only precious metals in a SHTF scenario are lead and brass.

- smackaholic

- Walrus Team 6

- Posts: 21748

- Joined: Sat Jan 15, 2005 2:46 pm

- Location: upside it

Re: SBV collapse.

You think all 401K money is in equities?Bill in Houston wrote: ↑Mon Mar 13, 2023 3:32 pmMillions of Americans who hold trillions of dollars in retirement accounts invest those assets in stocks. Many of them don’t even know what the tax rate will ultimately be on their distribution.smackaholic wrote: ↑Sun Mar 12, 2023 5:52 pm

Of course the tax isn’t the risk, dumbfukk. It is a reduction of the reward for taking the risk and therefore, it will affect investor’s decision on how much to risk or whether they should even bother.

This says what about your theory?

Is that what you are going with?

Much is, but a fair bit isn't. Many of the uber rich who don't need big returns, stuff a lot of it in T bills. And with a 40% tax, those T bills look even better.

mvscal wrote:The only precious metals in a SHTF scenario are lead and brass.

-

Kierland

Re: SBV collapse.

Dump killed Dodd-Frank which would have prevented this and now Brandon has to clean up another of Dump’s messes.smackaholic wrote: ↑Tue Mar 14, 2023 1:04 amThat's what your master Sleepy Joe did. Or are you gonna figure out a way to pin this on Trump too.Screw_Michigan wrote: ↑Mon Mar 13, 2023 12:08 am Yeah, bail out a bunch of rich assholes but how DARE Jimmy or Johnny failed student get $20k of student loans forgiven? FUCK THEM

https://www.washingtonpost.com/us-polic ... -deposits/

He did it because the overwhelming majority of those account are held by Silicon Valley tech companies. And they are your people.

So, the precedent is now set. FDIC now guarantees accounts to 250K, or maybe 250 billion, if Joe feels like it.

- smackaholic

- Walrus Team 6

- Posts: 21748

- Joined: Sat Jan 15, 2005 2:46 pm

- Location: upside it

Re: SBV collapse.

Bullshit.

Dodd/Frank wouldn't have prevented run away inflation.

That is what sunk these idiots, well, that and being fukking morons who don't know how to spread their risk around.

They simply weren't very good at picking investments and they also ran into some bad luck.

But smart investors account for bad luck. These dudes were too busy catering to the alphabet soup squad and ESG. And it bit them in the ass.

Sadly, there will be more to follow once everyone realizes what a shitstorm we are in thanks to about 15 years of pretending that free money is a good thing (a bipartisan effort, btw).

I suspect that even if we didn't have a comatose stooge at the helm, we'd have eventually hit this iceberg anyway, but he did speed it up a bit.

Dodd/Frank wouldn't have prevented run away inflation.

That is what sunk these idiots, well, that and being fukking morons who don't know how to spread their risk around.

They simply weren't very good at picking investments and they also ran into some bad luck.

But smart investors account for bad luck. These dudes were too busy catering to the alphabet soup squad and ESG. And it bit them in the ass.

Sadly, there will be more to follow once everyone realizes what a shitstorm we are in thanks to about 15 years of pretending that free money is a good thing (a bipartisan effort, btw).

I suspect that even if we didn't have a comatose stooge at the helm, we'd have eventually hit this iceberg anyway, but he did speed it up a bit.

mvscal wrote:The only precious metals in a SHTF scenario are lead and brass.

-

Kierland

Re: SBV collapse.

So they suck at Capitalism which is what Dodd-Frank was meant to protect depositors from but it wouldn’t have helped. You can just admit you have no idea what DF did.smackaholic wrote: ↑Tue Mar 14, 2023 2:30 am Bullshit.

Dodd/Frank wouldn't have prevented run away inflation.

That is what sunk these idiots, well, that and being fukking morons who don't know how to spread their risk around.

They simply weren't very good at picking investments and they also ran into some bad luck.

But smart investors account for bad luck. These dudes were too busy catering to the alphabet soup squad and ESG. And it bit them in the ass.

Sadly, there will be more to follow once everyone realizes what a shitstorm we are in thanks to about 15 years of pretending that free money is a good thing (a bipartisan effort, btw).

I suspect that even if we didn't have a comatose stooge at the helm, we'd have eventually hit this iceberg anyway, but he did speed it up a bit.

- Bill in Houston

- Eternal Scobode

- Posts: 1151

- Joined: Wed Jun 10, 2020 12:29 am

Re: SBV collapse.

I didn’t say all 401k money was in equities. Nice strawman attempt. Try reading what I said and address that, or not since you’re now spinning.smackaholic wrote: ↑Tue Mar 14, 2023 1:09 amYou think all 401K money is in equities?Bill in Houston wrote: ↑Mon Mar 13, 2023 3:32 pmMillions of Americans who hold trillions of dollars in retirement accounts invest those assets in stocks. Many of them don’t even know what the tax rate will ultimately be on their distribution.smackaholic wrote: ↑Sun Mar 12, 2023 5:52 pm

Of course the tax isn’t the risk, dumbfukk. It is a reduction of the reward for taking the risk and therefore, it will affect investor’s decision on how much to risk or whether they should even bother.

This says what about your theory?

Is that what you are going with?

Much is, but a fair bit isn't. Many of the uber rich who don't need big returns, stuff a lot of it in T bills. And with a 40% tax, those T bills look even better.

You’re now saying that T-bills are more attractive with a 40% tax rate? Wtf? Why?

- smackaholic

- Walrus Team 6

- Posts: 21748

- Joined: Sat Jan 15, 2005 2:46 pm

- Location: upside it

Re: SBV collapse.

Do you even understand the definition of risk?Bill in Houston wrote: ↑Tue Mar 14, 2023 4:51 amI didn’t say all 401k money was in equities. Nice strawman attempt. Try reading what I said and address that, or not since you’re now spinning.smackaholic wrote: ↑Tue Mar 14, 2023 1:09 amYou think all 401K money is in equities?Bill in Houston wrote: ↑Mon Mar 13, 2023 3:32 pm

Millions of Americans who hold trillions of dollars in retirement accounts invest those assets in stocks. Many of them don’t even know what the tax rate will ultimately be on their distribution.

This says what about your theory?

Is that what you are going with?

Much is, but a fair bit isn't. Many of the uber rich who don't need big returns, stuff a lot of it in T bills. And with a 40% tax, those T bills look even better.

You’re now saying that T-bills are more attractive with a 40% tax rate? Wtf? Why?

A T-bill gives you a GUARANTEED return. And if I'm not mistaken, they are tax free.

So, yeah, right about now, a tax free 5% might be looking pretty good compared to putting your money at risk in say, something like SVB stock where it might vanish.

Risk/reward calculations change when it becomes risk/60% of reward.

What is so hard to understand here?

mvscal wrote:The only precious metals in a SHTF scenario are lead and brass.

- Screw_Michigan

- Angry Snowflake

- Posts: 21095

- Joined: Wed Feb 17, 2010 2:37 am

- Location: 20011

-

Kierland

Re: SBV collapse.

Yellow, but make sure you blame me for it.smackaholic wrote: ↑Tue Mar 14, 2023 12:57 am

As I was saying last week, I've never used the ignore feature because as Nish said, "A board NEEDS its tards", but damn, he really does stretch that rule to its limits. I think I may just have to do the same, for the reasons you state. He absolutely refuses to debate a topic like an adult.

-

Kierland

Re: SBV collapse.

More lies, I don’t have anyone on ignore & I’m still even posting to you and you are a bot.

-

Sven Golly

- Elwood

- Posts: 890

- Joined: Wed Sep 21, 2022 9:11 pm

Re: SBV collapse.

Unfortunately, Uncle Sam gets a bite out of interest paid on T-bills, bonds, and notes, however they are tax exempt at the state and local levels.smackaholic wrote: ↑Tue Mar 14, 2023 10:20 amDo you even understand the definition of risk?Bill in Houston wrote: ↑Tue Mar 14, 2023 4:51 amI didn’t say all 401k money was in equities. Nice strawman attempt. Try reading what I said and address that, or not since you’re now spinning.smackaholic wrote: ↑Tue Mar 14, 2023 1:09 am

You think all 401K money is in equities?

Is that what you are going with?

Much is, but a fair bit isn't. Many of the uber rich who don't need big returns, stuff a lot of it in T bills. And with a 40% tax, those T bills look even better.

You’re now saying that T-bills are more attractive with a 40% tax rate? Wtf? Why?

A T-bill gives you a GUARANTEED return. And if I'm not mistaken, they are tax free.

So, yeah, right about now, a tax free 5% might be looking pretty good compared to putting your money at risk in say, something like SVB stock where it might vanish.

Risk/reward calculations change when it becomes risk/60% of reward.

What is so hard to understand here?

Re: SBV collapse.

Evidently, inflation seems to be hard to understand heresmackaholic wrote: ↑Tue Mar 14, 2023 10:20 am

Do you even understand the definition of risk?

A T-bill gives you a GUARANTEED return. And if I'm not mistaken, they are tax free.

So, yeah, right about now, a tax free 5% might be looking pretty good compared to putting your money at risk in say, something like SVB stock where it might vanish.

Risk/reward calculations change when it becomes risk/60% of reward.

What is so hard to understand here?

Screw_Michigan wrote: ↑Fri Apr 05, 2019 4:39 pmUnlike you tards, I actually have functioning tastebuds and a refined pallet.

-

Kierland

Re: SBV collapse.

Well you seem to think it has nothing to do with you guys handing out money to rich people or corporate kleptos so yeah it is.

- Smackie Chan

- Eternal Scobode

- Posts: 7311

- Joined: Fri May 20, 2005 1:56 pm

- Location: Inside Your Speakers

Re: SBV collapse.

Perspective from a financial pro:

Additionally, outside the scope of bank failures, low unemployment rates are generally considered positive. However, from an inflation perspective, very low unemployment/high jobs supply feeds inflation. One of the aims of the Fed pushing interest rates higher is to raise the unemployment rate and cool the jobs market, with the goal of stabilizing/lowering inflation.Last week, two California banks collapsed, causing stock markets to retreat. One of the bank closures was the second largest in U.S. history with over $200 billion in assets. The news came as somewhat of a surprise and raised investor worries. Will there be more bank closures, and will these two closures ripple through the economy?

Unique Banks with Liquidity Events, Not Solvency Events

These two banks served a very niche client base that is not representative of most other banks. The larger bank’s clients were predominantly start-up companies and venture capital companies. The smaller bank’s customers were largely customers in the cryptocurrency business.

The customer bases of these banks were not diversified, and their customers relied heavily on low interest rates. At low interest rates, entrepreneurs can borrow money to start new companies. With the Fed raising interest rates at an unprecedented rate, start-ups (which may not be net cash flow positive) had to use their existing cash balances to pay rents and salaries as new investment capital dried up and borrowing costs rose. Since these banks’ customer bases were not diversified, their customers were facing similar challenges simultaneously and needed their money at the same time, causing a run on the banks. This is what caused the banks to close.

This liquidity crunch ultimately doomed the banks that were already hurting because their investments were predominantly in longer dated U.S. Treasury assets. Because bond prices move inversely to yields, these bonds were recently devalued when long-term bond yields rose. It is important to note that these were liquidity events and not solvency events. While the banks’ asset values did fall with rising bond yields, the assets were performing, unlike 2008 when the underlying mortgage assets were not performing assets

Systemic Risk?

It does not appear that these closures will be a systemic risk to the economy. The Federal Government has stepped in and will allow customers of the large bank to have access to their cash. This relieves concerns around liquidity for the customers at the bank as they begin trying to pay payrolls and other bills. We will be watching the government’s future actions closely in the coming weeks. U.S. Treasury Security Janet Yellen made it clear that she is not in favor of bank bailouts, but she seemed more sympathetic to customers’ liquidity needs.

Summary

This is a painful reminder of the consequences from the Federal Reserve tightening financial conditions. Fed tightening is now showing its mark in banks as well as start-up companies and high growth companies. These recent events may cause the Fed to pause their interest rate hikes sooner than previously expected, and even pivot and lower rates later in the year. They may want to wait and observe the impact they are having on different areas of the economy, since there is a lag between their policy moves and the impact from those moves. Since the Fed began to raise rates only one year ago, much of the policy impact has not been felt yet.

Stultorum infinitus est numerus

-

Kierland

Re: SBV collapse.

The only thing that feeds inflation is rising prices. Prices don’t rise in a competitive market due to low unemployment. You’re talking about a rigged market…. Oh wait, never mind.

-

Sven Golly

- Elwood

- Posts: 890

- Joined: Wed Sep 21, 2022 9:11 pm

Re: SBV collapse.

A tight labor market ABSOLUTELY contributes to inflation dipshit. God you are ignorant.

I guess you’re done with C&H now.

I guess you’re done with C&H now.

-

Kierland

Re: SBV collapse.

How? You just lower profits for the fat cats and leave the selling price the same. Easy as pie.Sven Golly wrote: ↑Tue Mar 14, 2023 5:13 pm A tight labor market ABSOLUTELY contributes to inflation dipshit. God you are ignorant.

I guess you’re done with C&H now.

-

Sven Golly

- Elwood

- Posts: 890

- Joined: Wed Sep 21, 2022 9:11 pm

Re: SBV collapse.

Yeah, easy as pieKierland wrote: ↑Tue Mar 14, 2023 5:25 pmHow? You just lower profits for the fat cats and leave the selling price the same. Easy as pie.Sven Golly wrote: ↑Tue Mar 14, 2023 5:13 pm A tight labor market ABSOLUTELY contributes to inflation dipshit. God you are ignorant.

I guess you’re done with C&H now.

-

Sven Golly

- Elwood

- Posts: 890

- Joined: Wed Sep 21, 2022 9:11 pm

Re: SBV collapse.

Try to stick to kids’ books vs discussion about finance and economics

-

Sven Golly

- Elwood

- Posts: 890

- Joined: Wed Sep 21, 2022 9:11 pm

Re: SBV collapse.

Or better yet, reread the Constitution

-

Kierland

Re: SBV collapse.

Nice white flag. Just how will the fat cats pay for a third yacht?Sven Golly wrote: ↑Tue Mar 14, 2023 5:43 pm Try to stick to kids’ books vs discussion about finance and economics

-

Kierland

Re: SBV collapse.

Oh do tell, what part did I miss?

- smackaholic

- Walrus Team 6

- Posts: 21748

- Joined: Sat Jan 15, 2005 2:46 pm

- Location: upside it

Re: SBV collapse.

Thanks for the clarification. I knew there was some tax benefit. Thought it might extend to the fed level. Guess I should know better.Sven Golly wrote:Unfortunately, Uncle Sam gets a bite out of interest paid on T-bills, bonds, and notes, however they are tax exempt at the state and local levels.smackaholic wrote: ↑Tue Mar 14, 2023 10:20 amDo you even understand the definition of risk?Bill in Houston wrote: ↑Tue Mar 14, 2023 4:51 am I didn’t say all 401k money was in equities. Nice strawman attempt. Try reading what I said and address that, or not since you’re now spinning.

You’re now saying that T-bills are more attractive with a 40% tax rate? Wtf? Why?

A T-bill gives you a GUARANTEED return. And if I'm not mistaken, they are tax free.

So, yeah, right about now, a tax free 5% might be looking pretty good compared to putting your money at risk in say, something like SVB stock where it might vanish.

Risk/reward calculations change when it becomes risk/60% of reward.

What is so hard to understand here?

Sent from my iPhone using Tapatalk

mvscal wrote:The only precious metals in a SHTF scenario are lead and brass.

-

Sven Golly

- Elwood

- Posts: 890

- Joined: Wed Sep 21, 2022 9:11 pm

Re: SBV collapse.

This is the worst goddamn time of the year. I just did my taxes and realized the cap gains taxes are much higher than I remember. :xsmackaholic wrote: ↑Tue Mar 14, 2023 7:49 pmThanks for the clarification. I knew there was some tax benefit. Thought it might extend to the fed level. Guess I should know better.Sven Golly wrote:Unfortunately, Uncle Sam gets a bite out of interest paid on T-bills, bonds, and notes, however they are tax exempt at the state and local levels.smackaholic wrote: ↑Tue Mar 14, 2023 10:20 am

Do you even understand the definition of risk?

A T-bill gives you a GUARANTEED return. And if I'm not mistaken, they are tax free.

So, yeah, right about now, a tax free 5% might be looking pretty good compared to putting your money at risk in say, something like SVB stock where it might vanish.

Risk/reward calculations change when it becomes risk/60% of reward.

What is so hard to understand here?

Sent from my iPhone using Tapatalk