Re: Doom

Posted: Mon Dec 28, 2020 2:09 am

... have been run from this board.SM wrote:Trumpster Qanon believing whack jobs

Johnny Cash's bastard son?

"5G is the devil" is a school of though perpetrated by Qanon believing, Trump endorsing whack jobs. Hate to break it to you.smackaholic wrote: ↑Mon Dec 28, 2020 11:16 am Read something saying that he was a loaner IT geek who may have signed on to the "5G is the devil" school of thought.

If he had much of a political bent, left or right, we should find out soon.

It does seem he was out to kill things, not people.

Hate to break it to you -- all the 5G freaks I know are quite the opposite.Screw_Michigan wrote: ↑Mon Dec 28, 2020 2:02 pm

"5G is the devil" is a school of though perpetrated by Qanon believing, Trump endorsing whack jobs. Hate to break it to you.

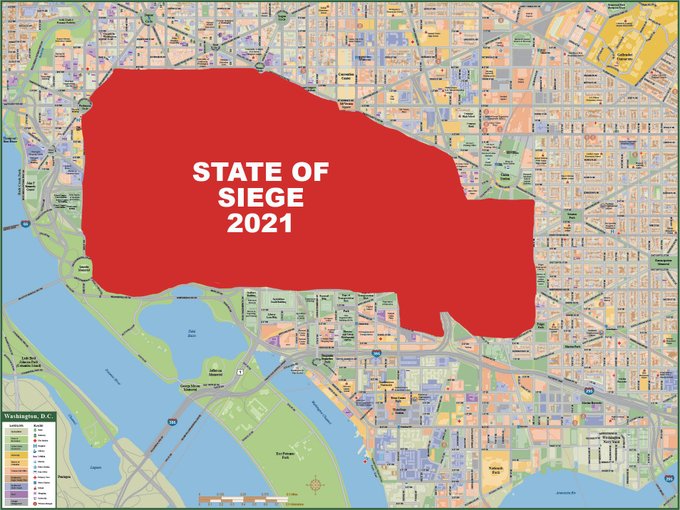

Well at least he gave his life for a worthy cause: Donald Trump's fascism.Diego in Seattle wrote: ↑Wed Dec 30, 2020 3:18 am Is 41 considered "elderly?"

Asking for Rep-Elect Luke Letlow....

Hate to break it to you but in addition to you being a proud, seditious, orange, ditch-digging POS you are also using anecdotal evidence. Now kindly fuck off.Dinsdale wrote: ↑Wed Dec 30, 2020 2:46 amHate to break it to you -- all the 5G freaks I know are quite the opposite.Screw_Michigan wrote: ↑Mon Dec 28, 2020 2:02 pm

"5G is the devil" is a school of though perpetrated by Qanon believing, Trump endorsing whack jobs. Hate to break it to you.

This should never be an option. Family should never loan money, it should always be given with no expectation of return. Who were the Jeff Bezos' and Mitt Romney's out there who thought destitute people borrowing from other destitute people was viable and acceptable?Softball Bat wrote: ↑Tue Dec 29, 2020 11:06 pm

“If you’re putting your rent payments on to a credit card, that shows you’re really at risk of eviction,” says Shamus Roller, executive director of the nonprofit National Housing Law Project. “That means you’ve run out of savings; you’ve probably run out of calls to family members to get them to loan you money.

There is a link between vaccines and autism -- the real autism, where babies stopped smiling, not the awkward NEET meme bs -- just like DuPont really did poison the water and the US government really did intentionally flood the inner city with narcotics.

Dinsdale is the biggest hippie on the planet.

In your mind.

Women know their babies.

It’s all choices. What are the probabilities?Innocent Bystander wrote: ↑Wed Dec 30, 2020 5:06 pmThere is a link between vaccines and autism -- the real autism, where babies stopped smiling, not the awkward NEET meme bs -- just like DuPont really did poison the water and the US government really did intentionally flood the inner city with narcotics.

Why is anti-vax a bad word?

The probability is that there's a fire producing this much smoke.Bill in Houston wrote: ↑Wed Dec 30, 2020 9:54 pmIt’s all choices. What are the probabilities?

I think vaxs have done a lot of good.

Are you waiting for promise and guarantee?

First of all rent/mortgages should be paid by a miles/points/cash back credit card. Then turn around and pay the card bill. Cash gets you no rewards.Innocent Bystander wrote: ↑Wed Dec 30, 2020 5:01 pmThis should never be an option. Family should never loan money, it should always be given with no expectation of return. Who were the Jeff Bezos' and Mitt Romney's out there who thought destitute people borrowing from other destitute people was viable and acceptable?Softball Bat wrote: ↑Tue Dec 29, 2020 11:06 pm

“If you’re putting your rent payments on to a credit card, that shows you’re really at risk of eviction,” says Shamus Roller, executive director of the nonprofit National Housing Law Project. “That means you’ve run out of savings; you’ve probably run out of calls to family members to get them to loan you money.

- What would you do if your son was at homeLeft Seater wrote: ↑Wed Jan 06, 2021 2:45 pmFirst of all rent/mortgages should be paid by a miles/points/cash back credit card. Then turn around and pay the card bill. Cash gets you no rewards.Innocent Bystander wrote: ↑Wed Dec 30, 2020 5:01 pmThis should never be an option. Family should never loan money, it should always be given with no expectation of return. Who were the Jeff Bezos' and Mitt Romney's out there who thought destitute people borrowing from other destitute people was viable and acceptable?Softball Bat wrote: ↑Tue Dec 29, 2020 11:06 pm

“If you’re putting your rent payments on to a credit card, that shows you’re really at risk of eviction,” says Shamus Roller, executive director of the nonprofit National Housing Law Project. “That means you’ve run out of savings; you’ve probably run out of calls to family members to get them to loan you money.

Your wife has generational wealth, and you may have it as well, if you are not piggybacking off of her and her mother. The beneficiaries of generational wealth have a different perspective of 'constantly bail out financially' than those who live paycheck to paycheck.B) Sure it is appropriate to give money to family members at a point in time. However, if said family members are constantly asking for money a loan may be appropriate. If you are constantly there to bail them out financially they have no incentive to make a change. See also if they are using the funds given to sustain a habit.

Female cousins, eh? :oMy wife and I paid for two of my cousins to attend college. We had a contract with them that required certain things like a full time class load, minimum GPA, summer school or an internship/job in their field. Each of the girls had one semester where they didn’t fulfill the contract. When that was a one off and they graduated we wiped everything clean. One of them is now in grad school under the same contract.

I'm saying, mamas know their babies, and when something has drastically changed with their babies. It will come out, in the 2040s, but it will come out -- just like Tuskegee. The first whistleblowing by a white was in the 60s, not in the 70s. How many more, of either race, before him?Bill in Houston wrote: ↑Mon Jan 04, 2021 8:54 pm Smoke? WTH are you saying?

"A lot of normal babies"? Mean what exactly?

I'm sure you have some bs link(s) to throw up in this bitch

What does that have to do with your post which I questioned?Innocent Bystander wrote: ↑Wed Jan 06, 2021 3:34 pmI'm saying, mamas know their babies, and when something has drastically changed with their babies. It will come out, in the 2040s, but it will come out -- just like Tuskegee. The first whistleblowing by a white was in the 60s, not in the 70s. How many more, of either race, before him?Bill in Houston wrote: ↑Mon Jan 04, 2021 8:54 pm Smoke? WTH are you saying?

"A lot of normal babies"? Mean what exactly?

I'm sure you have some bs link(s) to throw up in this bitch

So take Tuskegee as my link.

I don't know. But credit cards are crazy easy to get. Rewards cards might take a few points higher, but doctorofcredit shows rewards cards that are regularly approved for folks with credit scores above 650.Innocent Bystander wrote: ↑Wed Jan 06, 2021 3:29 pm

Anyway, what credit score did you have to have to qualify for a rewards card, let alone one which covered your entire rent/mortgage, LS?

What credit score range are moat people living paycheck to paycheck, in comparison?

What are you basing my wife having generational wealth on? She didn't get anything from her parents money wise except for an undergraduate college education. She and I paid for her MBA along with her employer at the time. In the last 3 years my wife and I purchased a condo for her parents in San Antonio. We pay the mortgage, they pay the taxes and utilities and HOA. How exactly is that generational wealth? Same for me? My mom has a house that is in a family trust that she created to avoid estate taxes in the future. However, that may not be necessary, we will see what the Dems do over the next few years. But handing down a home to my brother and I is hardly generational wealth.Innocent Bystander wrote: ↑Wed Jan 06, 2021 3:29 pm Your wife has generational wealth, and you may have it as well, if you are not piggybacking off of her and her mother. The beneficiaries of generational wealth have a different perspective of 'constantly bail out financially' than those who live paycheck to paycheck.

No, in my opinion it is never appropriate to give money to family with the expectation it will be returned. Only give what you can afford to lose forever.

As for habits, are you down for footing recovery center bills?

Or you ain't that tax bracket yet?

I have no clue what you will find. I do know that both are working in their college field of study. One is working on a marketing campaign for a national brand that all of us are familiar with.Innocent Bystander wrote: ↑Wed Jan 06, 2021 3:29 pm Female cousins, eh? :o

If I do a sugar baby search online, you sure I won't find them?

We were happy to do that for them. They have proven to be a good investment. As for folks living paycheck to paycheck it might be possible. Far too many in the US are doing just fine income wise, but are still living paycheck to paycheck. Some of that is the stupid cost of living in cities on the West Coast or in NYC and some of that is due to spending choices. No one with a $200K family income should be living paycheck to paycheck, but many are.Innocent Bystander wrote: ↑Wed Jan 06, 2021 3:29 pm But that's cool you were able to do that. That's not happening for folks living paycheck to paycheck. But they are lucky to have you be able to do that for them.

Fat greedy Nazi slinks back, just to brag about $.Left Seater wrote: ↑Thu Jan 07, 2021 6:40 pmI don't know. But credit cards are crazy easy to get. Rewards cards might take a few points higher, but doctorofcredit shows rewards cards that are regularly approved for folks with credit scores above 650.Innocent Bystander wrote: ↑Wed Jan 06, 2021 3:29 pm

Anyway, what credit score did you have to have to qualify for a rewards card, let alone one which covered your entire rent/mortgage, LS?

What credit score range are moat people living paycheck to paycheck, in comparison?

What are you basing my wife having generational wealth on? She didn't get anything from her parents money wise except for an undergraduate college education. She and I paid for her MBA along with her employer at the time. In the last 3 years my wife and I purchased a condo for her parents in San Antonio. We pay the mortgage, they pay the taxes and utilities and HOA. How exactly is that generational wealth? Same for me? My mom has a house that is in a family trust that she created to avoid estate taxes in the future. However, that may not be necessary, we will see what the Dems do over the next few years. But handing down a home to my brother and I is hardly generational wealth.Innocent Bystander wrote: ↑Wed Jan 06, 2021 3:29 pm Your wife has generational wealth, and you may have it as well, if you are not piggybacking off of her and her mother. The beneficiaries of generational wealth have a different perspective of 'constantly bail out financially' than those who live paycheck to paycheck.

No, in my opinion it is never appropriate to give money to family with the expectation it will be returned. Only give what you can afford to lose forever.

As for habits, are you down for footing recovery center bills?

Or you ain't that tax bracket yet?

As for recovery center bills, I would certainly consider it. Family should help family when/where appropriate. If a family member came to us and said they were at rock bottom and wanted to change, we would certainly listen and likely help.

I have no clue what you will find. I do know that both are working in their college field of study. One is working on a marketing campaign for a national brand that all of us are familiar with.Innocent Bystander wrote: ↑Wed Jan 06, 2021 3:29 pm Female cousins, eh? :o

If I do a sugar baby search online, you sure I won't find them?

We were happy to do that for them. They have proven to be a good investment. As for folks living paycheck to paycheck it might be possible. Far too many in the US are doing just fine income wise, but are still living paycheck to paycheck. Some of that is the stupid cost of living in cities on the West Coast or in NYC and some of that is due to spending choices. No one with a $200K family income should be living paycheck to paycheck, but many are.Innocent Bystander wrote: ↑Wed Jan 06, 2021 3:29 pm But that's cool you were able to do that. That's not happening for folks living paycheck to paycheck. But they are lucky to have you be able to do that for them.