The Coming Market Crash

Moderator: Jesus H Christ

-

KC Scott

The Coming Market Crash

Just an FYI for those of you with $$$ in Stocks, your 401K or Mutual Funds -

This Market is getting ready for a severe correction.

I don't know what the "spark" will be that ignites the sell off

(A small terrorist attack, or maybe just a slew of bad earnings announcements

- possibly the Fed not talking about cutting interest rates next year)

- But whatever it will be it - will be sudden and it will be vicious.

Watch for the following; The Nasdaq will drop hard within the next 6 weeks.

First level of support, when it starts to go south, will be this summers lows around 2,012.

Once that gets taken out - it could fall all the way to 1750 - about 2 years worth of gains.

Of course, this will drag the S&P 500 and the Dow right down with it.

The bottom will finaly form when semi conductors (SOX) index advances from a sustained bottom.

Take this for what it's worth....

I'd rather play it safe and be in cash than go through the drop we had in 01-02.

This Market is getting ready for a severe correction.

I don't know what the "spark" will be that ignites the sell off

(A small terrorist attack, or maybe just a slew of bad earnings announcements

- possibly the Fed not talking about cutting interest rates next year)

- But whatever it will be it - will be sudden and it will be vicious.

Watch for the following; The Nasdaq will drop hard within the next 6 weeks.

First level of support, when it starts to go south, will be this summers lows around 2,012.

Once that gets taken out - it could fall all the way to 1750 - about 2 years worth of gains.

Of course, this will drag the S&P 500 and the Dow right down with it.

The bottom will finaly form when semi conductors (SOX) index advances from a sustained bottom.

Take this for what it's worth....

I'd rather play it safe and be in cash than go through the drop we had in 01-02.

-

MgoBlue-LightSpecial

- Eternal Scobode

- Posts: 21259

- Joined: Wed Jan 19, 2005 2:35 pm

-

KC Scott

-

KC Scott

-

BSmack

- 2005 and 2010 JFFL Champion

- Posts: 29350

- Joined: Sat Jan 15, 2005 2:21 pm

- Location: Lookin for tards

FTFYCuda wrote:If I could find an antique Hamms Beer neon sign in good condition, I could sell it to Fester & still be unemployed

"Once upon a time, dinosaurs didn't have families. They lived in the woods and ate their children. It was a golden age."

—Earl Sinclair

"I do have respect for authority even though I throw jelly dicks at them.

- Antonio Brown

—Earl Sinclair

"I do have respect for authority even though I throw jelly dicks at them.

- Antonio Brown

- TenTallBen

- No title

- Posts: 1975

- Joined: Sat Jan 15, 2005 8:07 pm

- Location: Zydeco Country

Re: The Coming Market Crash

KC Scott wrote:

-

KC Scott

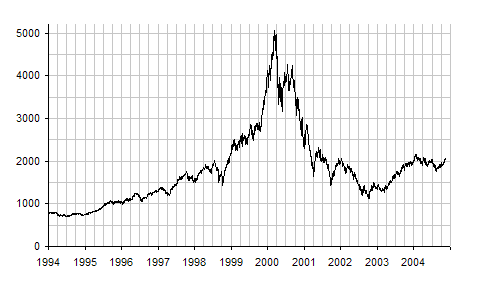

Here's the deal - If the Nasdaq can't make it back above that top trend line, it will fall - and when it does it will be fastNASDQ wrote:

It will fall a long way since there is not a lot of support below the 2030 line.

When it punctured the lower trend line in May, it broke a 2 year uptrend which also was a continuation of the bull market since the last bottom in August 2002.

There's a lot more to it than just this - the collapse of housing market, and now the drop in oil and commodities.

That's a lot of wealth disappearing everyday.

Add the rising interest rate, the declining economy and people are not going to continue to buy stocks at higher prices.

I agree with Mikey that Techs are not as overvalued as the 2000 bubble - but that's what makes this even worse.

When people and institutions sell in this drop, they won't move into any other sector.

Cash is king for now people.

If the market in this first decade of the 21st century were to duplicate the worst ten-year performance since the end of the Second World War, the 1.24 average annual percent return between 1965 and 1974, it would have to produce annual returns of 8.2 percent during the rest of the decade.

If the market were to duplicate its worst performance since 1970, 5.86 percent between 1970 and 1979, it would have to rise at a 15 percent annual rate for the rest of the decade.

For the market in this decade to produce its average ten-year performance of the entire 76-year period, it would have to return 22.4 percent annually for the next seven-plus years.

For the index to duplicate the average ten-year return of the post World War II period, it would have to rise at a 25 percent annual rate for the rest of this decade.

So yeah, KCS, you could be right.

But I don't see it.

If the market were to duplicate its worst performance since 1970, 5.86 percent between 1970 and 1979, it would have to rise at a 15 percent annual rate for the rest of the decade.

For the market in this decade to produce its average ten-year performance of the entire 76-year period, it would have to return 22.4 percent annually for the next seven-plus years.

For the index to duplicate the average ten-year return of the post World War II period, it would have to rise at a 25 percent annual rate for the rest of this decade.

So yeah, KCS, you could be right.

But I don't see it.

- War Wagon

- 2010 CFB Pickem Champ

- Posts: 21127

- Joined: Fri Jan 14, 2005 2:38 pm

- Location: Tiger country

The housing market, which has kept the U.S. economy afloat for the past 10 years, hasn't exactly collapsed.

Sure, it's down compared to the past few years incredible numbers, but it's not out. It should rebound by Feb or Mar at the latest.

Folks will always need a roof over their head and a pot to piss in.

Sure, it's down compared to the past few years incredible numbers, but it's not out. It should rebound by Feb or Mar at the latest.

Folks will always need a roof over their head and a pot to piss in.

-

KC Scott

poptart wrote:I thought the market had it's correction a few months ago.

What factors lead you to your conclusion that a big drop is coming, Scott .... ?

David what happened over the summer is called a reaction rally.

People bought on the "dip" in price.

Now look at that chart I just posted - look at the bottom which indicates Volume.

See how the volume was much higher when it sold off (Red Lines) - the subsequent rise had less buyers.

And in supply and demand if you have more sellers than buyers the price will fall.

When this market falls, there will be multiple reaction rallys -

the thing is, they will never get past the previous price points (the trend line).

This is all big picture trend - and just like a rising tide lifts all boats,

A drought will ground all of them except the ones on wheels ;)

-

KC Scott

-

MgoBlue-LightSpecial

- Eternal Scobode

- Posts: 21259

- Joined: Wed Jan 19, 2005 2:35 pm

- Mister Bushice

- Drinking all the beer Luther left behind

- Posts: 9490

- Joined: Fri Jan 14, 2005 2:39 pm

All my money is in real estate. I've turned my initial investment of about 35K into 10 times that amount in just 7 years. Even if there is a dip over the next few months and slower growth after that, I'm good with it. There will be another boom, at which time I will cash out and retire.

I'm not gambling my money in the stock market. for one thing, I know too little about it. For another, to see real gains, you HAVE to gamble, and know when to get out, or to move.

I'm not gambling my money in the stock market. for one thing, I know too little about it. For another, to see real gains, you HAVE to gamble, and know when to get out, or to move.

If this were a dictatorship, it'd be a heck of a lot easier, just so long as I'm the dictator." —GWB Washington, D.C., Dec. 19, 2000

Martyred wrote: Hang in there, Whitey. Smart people are on their way with dictionaries.

War Wagon wrote:being as how I've got "stupid" draped all over, I'm not really sure.

No, all you have to do is watch the board and Scott will tell you when to buy and sell.Mister Bushice wrote:I'm not gambling my money in the stock market. for one thing, I know too little about it. For another, to see real gains, you HAVE to gamble, and know when to get out, or to move.

I also get 'private consultation' from him once a year for a $20 fee.

I'm good.

- Mister Bushice

- Drinking all the beer Luther left behind

- Posts: 9490

- Joined: Fri Jan 14, 2005 2:39 pm

There's just too much to know. Selling short, margins, reading graphs and charts for "trends" Scott himself would tell you that it's a gamble, and if you play it too safe you won't see that much profit unless you are in it for the long haul.

No thanks. Real estate be treating me well. There's less risk in it, too.

No thanks. Real estate be treating me well. There's less risk in it, too.

If this were a dictatorship, it'd be a heck of a lot easier, just so long as I'm the dictator." —GWB Washington, D.C., Dec. 19, 2000

Martyred wrote: Hang in there, Whitey. Smart people are on their way with dictionaries.

War Wagon wrote:being as how I've got "stupid" draped all over, I'm not really sure.

- Mister Bushice

- Drinking all the beer Luther left behind

- Posts: 9490

- Joined: Fri Jan 14, 2005 2:39 pm

yep. :)

If this were a dictatorship, it'd be a heck of a lot easier, just so long as I'm the dictator." —GWB Washington, D.C., Dec. 19, 2000

Martyred wrote: Hang in there, Whitey. Smart people are on their way with dictionaries.

War Wagon wrote:being as how I've got "stupid" draped all over, I'm not really sure.

-

jiminphilly

- 2014 JFFL Champion

- Posts: 4553

- Joined: Mon Jan 17, 2005 1:59 pm

Why would the housing market suddenly pick up in the dead of winter for most of the North Eastern part of the US? Housing market is dramtically slowing down. Look at the condo market to see how bad it really is. Commercial real estate is up which can be good unless your a design professional in which case you might want to watch out for who is hiring you to do design work. Chances are those contractors and devlopers are looking to make up for their lost profits from the residential market and what better way than to sue.War Wagon wrote:The housing market, which has kept the U.S. economy afloat for the past 10 years, hasn't exactly collapsed.

Sure, it's down compared to the past few years incredible numbers, but it's not out. It should rebound by Feb or Mar at the latest.

Folks will always need a roof over their head and a pot to piss in.

People shouldn't gamble in the stock market. Gambling definitely involves a great deal of risk.Mister Bushice wrote:All my money is in real estate. I've turned my initial investment of about 35K into 10 times that amount in just 7 years. Even if there is a dip over the next few months and slower growth after that, I'm good with it. There will be another boom, at which time I will cash out and retire.

I'm not gambling my money in the stock market. for one thing, I know too little about it. For another, to see real gains, you HAVE to gamble, and know when to get out, or to move.

You should invest in the stock market. BIG difference.

Real estate is not inherently less risky than the market. If your real estate value takes a "dip", what do you do? Do you panic and sell? Most likely you hold on to it and let the price recover, just like you suggested. Why wouldn't you do the same with other investments?

Your thought process is in need of a good bit of education. I wouldn't suggest enrolling with KCScam.

- Uncle Fester

- The Man broke me chain

- Posts: 3164

- Joined: Mon Jan 17, 2005 7:58 pm

- Location: Abandoned Hamm's Brewery, St. Paul

- Mister Bushice

- Drinking all the beer Luther left behind

- Posts: 9490

- Joined: Fri Jan 14, 2005 2:39 pm

IN 2001, did the housing market crash because a couple of planes flew into buildings? No.Ruff wrote:

Real estate is not inherently less risky than the market. If your real estate value takes a "dip", what do you do? Do you panic and sell? Most likely you hold on to it and let the price recover, just like you suggested. Why wouldn't you do the same with other investments?

Would it crash if something like that happened again? NO. Would the stock market crash if something like that happened again? YES

The real estate market as a whole follows long term up and down cycles. The stock market is far more volatile. There are fewer factors to consider in real estate, and diversification on the same scale as the stock market is not necessary.

and I agree I'd need an education on investing in the stock market. I made that clear up above. Having the time it takes to learn, analyze and decide, and to be constantly alert for changes in trends is not something I'd want to invest in. I don't need another career.

-

KC Scott

mvscal wrote:That's what brokers are for.Mister Bushice wrote:and I agree I'd need an education on investing in the stock market. I made that clear up above. Having the time it takes to learn, analyze and decide, and to be constantly alert for changes in trends is not something I'd want to invest in. I don't need another career.

I hope your taking his advice then.

I'm sure he's earning his commissions.

What are your holdings?

-

KC Scott

- The Whistle Is Screaming

- Left-handed monkey wrench

- Posts: 2901

- Joined: Fri Jan 14, 2005 2:24 pm

- Location: Eat Me Luther, Eat Me!

mvscal wrote:That's what brokers are for.Mister Bushice wrote:and I agree I'd need an education on investing in the stock market. I made that clear up above. Having the time it takes to learn, analyze and decide, and to be constantly alert for changes in trends is not something I'd want to invest in. I don't need another career.

You see, it doesn't matter if our clients make money or lose money ... we get paid either way.

Ingse Bodil wrote:rich jews aren't the same as real jews, though, right?

-

KC Scott

Really?mvscal wrote:Good job shitting your bed. Enjoy the view on the way down. You are fucking up...badly.KC Scott wrote:In the Interest of Full Disclosure - Here's my positions on all indvidual stocks:

Short AMD @ 27.22

Short KLAC @ 45.86

Short ADI @ 31.69

Short QQQQ @ 40.88

Getting ready to Short ISIL

All Mutual Funds were sold and moved to Money Markets

Hmmm - I'm already up in 3 of those 4 positions

Of course it's Real easy to stand on the sideline and throw rocks - When you don't disclose.

Of course I wouldn't expect any more of you - Your typically a coward when it comes to putting it on the line

- ChargerMike

- 2007/2011 JFFL champ

- Posts: 5647

- Joined: Sat Jan 15, 2005 6:26 pm

- Location: So.Cal.

...my kid bought a house in the San Fernando Valley in 2004. He paid $335,000.00 with no money down and $2,000. back in non recurring closing costs. It cost him (me) about $6,000. in closing costs. The current market value of the house is $550,000. (down from $575,000. in March of this year).

Current equity $215,000. minus $6,000. closing costs =$209,000. minus $20,000 in upgrades =net equity of $195,000.00

$6,000 initial cash investment after 2 years = $195,000.00...somebody help me with the math here. Total per cent return on $6,000. in 2 years...........? is it somewhere around 1600% per year??

Current equity $215,000. minus $6,000. closing costs =$209,000. minus $20,000 in upgrades =net equity of $195,000.00

$6,000 initial cash investment after 2 years = $195,000.00...somebody help me with the math here. Total per cent return on $6,000. in 2 years...........? is it somewhere around 1600% per year??

JIP said...Hell, Michael Sam has more integrity than you do.